Issue Brief: Common Questions on Reimbursable Expenses

June 12, 2021

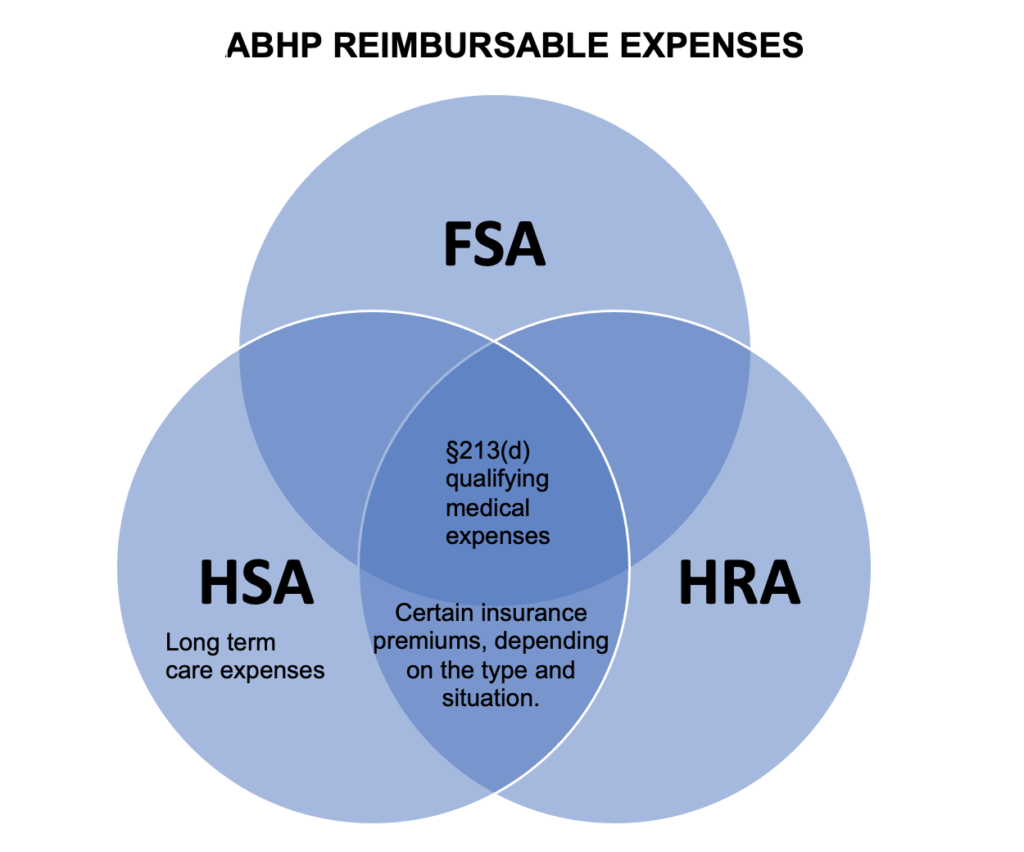

This issue brief will focus on determining whether an expense is reimbursable under Account Based Health Plans (ABHPs).[1] Specifically, we will look at the rules under Flexible Spending Arrangements (FSAs), Health Reimbursement Arrangements (HRAs), and Health Savings Accounts (HSAs). In general, all three ABHP types look to the definition of medical care, as provided in Section 213(d) of the tax code.

The term “medical care” means amounts paid—

(A) for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body,

(B) for transportation primarily for and essential to medical care referred to in subparagraph (A),

(C) for qualified long-term care services, or

(D) for insurance (including amounts paid as premiums under part B of title XVIII of the Social Security Act, relating to supplementary medical insurance for the aged) covering medical care referred to in subparagraphs (A) and (B) or for any qualified long-term care insurance contract.

FSAs

FSAs may be designed broadly to reimburse most §213(d) qualifying medical expenses, or they may be more limited in design. For example, employers offering a qualifying high deductible health plan (HDHP) may choose to offer a limited-purpose or post-deductible health FSA to preserve HSA-eligibility. However, health FSAs may not be used to pay for long-term care services or insurance premiums.

HSAs

HSAs are individually owned accounts. Therefore, employers do not have the ability to limit how employees use their HSA funds. That said, for an HSA distribution to be tax-free, it must be for a §213(d) qualifying medical expense. HSAs (unlike FSAs or HRAs) can be used to pay for long-term care expenses on a tax-free basis. In addition, while insurance premiums are generally not reimbursable under an HSA, there are several exceptions to this rule:

- continuation coverage under federal law (COBRA or USERRA) for the account holder, their spouse, and dependents;

- health plan premiums while the account holder, their spouse or dependent is receiving unemployment compensation under federal or state law;

- any deductible health insurance for HSA holders age 65 or over, other than a Medicare supplemental policy.

HRAs

HRAs may be designed broadly to reimburse most §213(d) qualifying medical expenses, or they can be more limited in design (e.g. available only to reimburse prescription drugs). An HRA might also be designed to be post-deductible or limited-purpose (i.e. available only to reimburse dental and vision expenses) in order to preserve HSA-eligibility. Unlike health FSAs and HSAs, an HRA could potentially be used to reimburse insurance premiums. However, most group health plan premiums are already being paid pre-tax through a cafeteria plan, in which case HRA reimbursement would be double-dipping and not permitted. Moreover, reimbursing individual health insurance premiums or Medicare is generally prohibited under healthcare reform rules unless the reimbursement is provided via a qualified small employer HRA (QSEHRA) or individual HRA (ICHRA). For these reasons, premium reimbursement is generally only available via a retiree HRA, Qualified Small Employer HRA (QSEHRA) or Individual Coverage HRA (ICHRA). HRAs generally may not reimburse expenses for long-term care services.

*This chart illustrates which expenses can be reimbursed from each type of ABHP on a tax favored basis.

Commonly Questioned Expenses

The following chart addresses common considerations of whether an expense is reimbursable. For a definitive answer as to the reimbursable status of an expense, the plan sponsor or individual should consult with a tax expert.

| Expense | Reimbursable Status |

| Masks, Gloves, Sanitizer | Reimbursable for the purpose of preventing spread of COVID-19 (beginning 2020), and other diseases where there is an imminent probability of contraction. |

| Diet Food | Not reimbursable unless prescribed by a health care provider (and not if especially expensive). |

| Vitamins/ Multivitamins | Not reimbursable unless prescribed by a health care provider. |

| Essential Oils/ Aromatherapy | Not reimbursable unless prescribed by a health care provider. Not reimbursable if used for general relaxation. |

| Gym Membership | Not reimbursable to improve general health. |

| Teletherapy | Reimbursable to treat a diagnosed medical condition, not reimbursable for the general improvement of mental health or relief of stress. |

| Over the Counter Medications | Reimbursable if for medical care, not reimbursable if for general health or cosmetic reasons. |

| Menstrual Products | Reimbursable. |

| Glasses, Contacts, Lasik | Reimbursable. |

| Dental, Orthodontia | Reimbursable. |

| Braille, Telephone Equipment, Hearing Aides | Reimbursable if provided to assist an individual with an impairment. |

| Handrails, Ramps | Reimbursable to accommodate a disability. |

| Wheelchair Automobile Access | Reimbursable if prescribed by a health care provider to accommodate a disability. |

| Travel, Lodging | Reimbursable up to certain limits, if there is no significant element of personal pleasure/ vacation, and the expense is not lavish/ extravagant. |

| Massage Chair, Hot tub | Not reimbursable unless prescribed by a health care provider to treat a specific condition. Not reimbursable if used for general relaxation or if expense would have been incurred even without the condition it is meant to treat. Not reimbursable if the expense is lavish/ extravagant. |

| Foreign Prescriptions | Not reimbursable. |

| Mold Removal | Not reimbursable unless prescribed by a health care provider. |

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it. This publication is distributed on the understanding that the publisher is not engaged in rendering legal, accounting or other professional advice or services. Readers should always seek professional advice before entering into any commitments.

[1] The determination of whether an expense is reimbursable under an ABHP should also consider for whom the expense is being submitted, and when the expense was incurred.