Overview of Medicare Secondary Payer Requirements

June 19, 2019

Introduction

Employers often wonder what types of premium assistance or other benefits they can provide to employees and family members who are eligible for or entitled to Medicare. For most employers, Medicare Secondary Payer (MSP) rules significantly limit the extent to which they are able to offer certain benefits. In addition, the MSP rules dictate which plan is considered to be the primary payer when an individual is entitled to Medicare and is enrolled in an employer’s group health plan. This issue brief provides an overview of the MSP rules and of how they impact the employer’s group health plan offering.

Background

General Requirements

The MSP rules prohibit a group health plan from “taking into account” the Medicare entitlement of a current employee or of a current employee’s spouse or family member.

Examples of “taking into account” Medicare entitlement include (but are not limited to):

- Failing to pay primary when required under the MSP rules.

- Offering coverage that is secondary to Medicare to individuals entitled to Medicare.

- Terminating coverage because somebody has become entitled to Medicare.

- Refusing to enroll individuals who are entitled to Medicare.

- Charging higher premiums, requiring longer waiting periods, or imposing plan limits for Medicare-entitled individuals.

- Providing misleading information to discourage people from enrolling in the group health plan.

The MSP rules also require a plan to provide a current employee or a current employee’s spouse who is age 65 or older with the same benefits, under the same conditions, as are provided to employees and spouses who are under age 65.

Finally, the MSP rules prohibit employers from discouraging employees from enrolling in their group health plans or from offering any “financial or other incentive” for an individual entitled to Medicare “not to enroll (or to terminate enrollment) under” a group health plan that would otherwise be a primary plan.

Who the MSP Rules Apply to

In general, the MSP rules apply to group health plans, including some non-ERISA plans such as church plans. Health FSAs and Qualified Small Employee Health Reimbursement Arrangements (QSEHRAs) are not subject to the MSP rules.

These rules apply differently to group health plans of different sizes. For example, the prohibition against taking into account age-based Medicare entitlement, and the requirement that employees and spouses age 65 or older receive the same benefits under the same conditions as employees and spouses who are under age 65, applies to group health plans of employers with 20 or more employees for each working day in at least 20 weeks in the current or the preceding calendar year.

Alternatively, the prohibition against taking into account disability-based Medicare entitlement applies to group health plans of employers that have at least 100 full-time or part-time employees on at least 50% of their regular business days during the previous calendar year.

Finally, the MSP rules apply to the group health plans of employers of all sizes with respect to individuals who are entitled to, or even eligible for, Medicare due to end-stage renal disease (ESRD).

For purposes of determining whether a plan is subject to the MSP rules, there are special rules that apply to multiemployer or multiple employer plans:

- If at least one of the employers in the plan has 20 or more employees, then MSP rules will apply. (However, the plan has the option of requesting that employers with fewer than 20 employers be able to opt out of the age-based MSP rules.)

- If at least one of the employers in the plan has 100 or more employees, then the plan will be subject to MSP rules for disabled employees. (There is no opt-out request option.)

The MSP rules generally apply to active employees and their spouses and family members. They do not apply to retirees who are covered under the group health plan. However, there is a special rule for rehired individuals who are entitled to retiree medical coverage. When these rehired individuals are covered by a group health plan and perform services that are the same as those performed by other employees in the same employment category who are eligible for benefits, then the MSP rules would apply.

It is important to note that the employer’s size is based on the number of employees and not on the number of participants in the group health plan. For this purpose, “employees” generally includes all common-law employees, including part-time employees. However, self-employed individuals who participate in the group health plan are not included in the count. In counting an employer’s employees, it is necessary to include all employees for all entities considered to be part of the same controlled group.

Coordination of Benefits

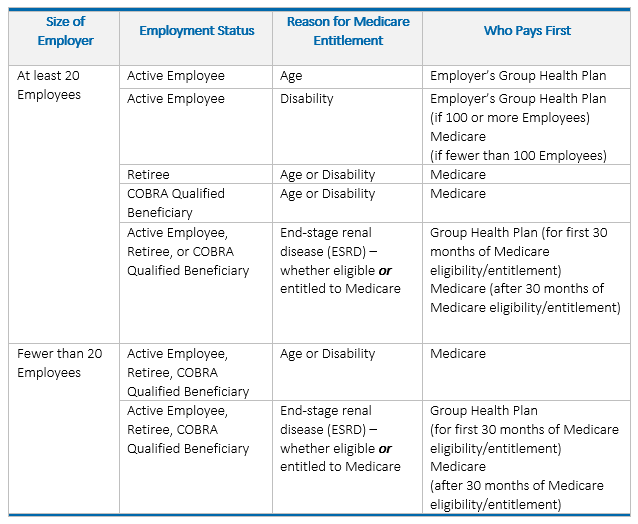

The MSP rules contain specific instructions for determining which plan is required to pay primary when an individual is entitled to Medicare and is enrolled in an employer’s group health plan (i.e., coordination of benefits).

The carrier or third-party administrator (TPA) will typically handle coordination of benefits, but it is beneficial for the employer to know when its group health plan is considered the primary payer. For most employers, the employer’s group health plan will be considered the primary payer and Medicare the secondary payer, at least for active employees and their family members. For small employers, Medicare may be considered the primary payer, but if the employee is eligible for Medicare, the group health plan may choose to insure only as a secondary payer regardless of whether the employee enrolls in Medicare.

Below is a chart that helps illustrate these general coordination of benefits principles.

Benefit Design Considerations

Differentiation in Benefits

Group health plans may make benefit distinctions among different categories of employees (e.g., based on geographic location), which may incidentally impact benefits for Medicare-eligbile employees. In general, as long as a plan makes the same distinctions for employees not entitled to Medicare as it does for employees entitled to Medicare, it won’t violate the MSP rules. But note that there are additional considerations for employers who offer opt-out/cash-in-lieu incentives or who allow premiums to be paid on a pre-tax basis through a cafeteria plan. These issues are discussed in greater detail below.

Opt-Out/Cash-in-Lieu Incentives

One particular benefit that raises potential MSP concerns is an opt-out incentive for waiving coverage. Although any kind of incentive targeting only those who are Medicare-eligible or entitled to Medicare would clearly violate MSP rules, it is less clear whether an opt-out incentive offered more broadly would be considered a violation.

Informal guidance provided via the ABA Joint Committee on Employee Benefits, Questions and Answers for CMS/HHS (May 8, 2002), Q&A #3, indicates that an opt-out arrangement run through a cafeteria plan, whether available to all who waive or to all who show proof of other coverage and not just to those who are Medicare-eligible, would not violate the MSP rules. However, CMS appears to take a different view in its MSP Manual, in which it indicates that the prohibition applies “even if the payments or benefits are offered to all other individuals who are eligible for coverage under the plan.”

Because there is no clear guidance indicating that an opt-out offered to Medicare-entitled employees is permissible, the most conservative approach would be to either: (i) offer the opt-out to all non-Medicare entitled employees who waive (the employer could rely on an affidavit from employees attesting that they’re not Medicare-entitled); or (ii) limit the opt-out to those who show proof of other group coverage (Medicare is not considered group coverage).

Reimbursing Medicare Policies/Premiums

In general, MSP rules prohibit employers from reimbursing premiums for Medicare or Medicare supplements directly or indirectly. Employers cannot allow employees to pay for premiums on a pre-tax basis through a cafeteria plan either.

There is a limited exception to the general ACA prohibition on reimbursement of individual market premiums for Medicare Premium Reimbursement Arrangements. Such arrangements must meet certain criteria to qualify for the exception.

But for an employer who is subject to the MSP rules, this limited exception wouldn’t seem viable, since the arrangement would violate the MSP prohibition on offering a financial incentive to encourage refraining from enrolling in a group health plan that would otherwise pay primary to Medicare. In other words, even if an employer could avoid violating the ACA with a properly structured Medicare Premium Reimbursement Arrangement, it would still have a problem from an MSP perspective if the employer has at least 20 employees.

Penalties for Noncompliance

Penalties for failing to comply with the MSP rules include:

- Civil penalties of up to $5,000 per violation for financial incentives.

- Reimbursement to Medicare for any payments made by Medicare if it is demonstrated that the employer’s plan was responsible for paying for the item or service.

- An excise tax penalty on employers who contribute to nonconforming group health plans of 25% of the employer’s expenses incurred during the calendar year for each group health plan (both conforming and nonconforming) to which they contribute.

Summary

When determining what types of benefits and/or incentives to offer their employees, employers must consider the potential impact the MSP rules might have on these benefits. The employer should have an understanding of when the employer’s group health plan is considered the primary payer. In addition, employers should avoid taking actions that will make the employer’s group health plan the less attractive option when compared with Medicare; most methods of doing so will violate MSP rules. Employees may freely choose between the employer’s group health plan and Medicare, but an employer with 20 or more employees must not play a role in that decision. If the employer restricts coverage, charges more for the coverage, or provides other incentives (e.g. cash) to encourage such individuals to choose Medicare over the employer’s group health plan, the employer is probably in violation of MSP rules.

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it. This publication is distributed on the understanding that the publisher is not engaged in rendering legal, accounting or other professional advice or services. Readers should always seek professional advice before entering into any commitments.